In today’s ever-evolving business landscape, where accuracy is the name of the game – any tool that can simplify the reconciliation process, save time and increase accuracy is an extremely valuable asset. In this article, you can get the answer to what is a bank reconciliation statement and why it is an important part of your company’s accounting strategy and the benefits of Reconciling Accounts in Zoho Books.

A bank reconciliation helps to minimise the margin for error, ensuring financial transactions are meticulously recorded and aligned with bank statements. However, reconciling bank and credit card accounts in Zoho Books can safeguard your transaction accuracy and integrity.

Also Read: Authorized Partners Of Zoho In India

What is a Bank Reconciliation Statement?

A bank reconciliation statement is a crucial accounting process that involves aligning two sets of bank balances: the one recorded in the company’s internal records and the corresponding balance presented in its bank statement.

The objective of the bank reconciliation statement in Zoho Books is to meticulously verify and reconcile these balances, ensuring complete consistency without any discrepancies.

This method serves to establish reliability and consistency in financial accounting by affirming that the funds exiting the company’s account correspond precisely to the officially documented expenditures.

Essentially, a bank reconciliation statement acts as a comprehensive validation tool, affirming the accuracy of financial transactions and expenditures within the organization.

Why Bank Reconciliation is Important to a Business?

A bank reconciliation is the quickest and easiest way to detect discrepancies in balances. Unexplained discrepancies serve as potential red flags, signalling the possibility of theft or fraud within the organization. In such cases, it becomes imperative to conduct a thorough investigation involving all relevant staff members.

Moreover, bank reconciliation acts as a proactive measure, enabling the identification of fraudulent activities as they unfold, rather than discovering them after the fact.

How to Reconcile Your Bank Accounts with Zoho Books?

With the best accounting software like Zoho Books, you can reconcile an account, ensuring alignment between the transactions recorded in your bank account and those entered in Zoho Books.

Additionally, you can customize the reconciliation period, opting for a specific reporting period or setting it to occur after each month.

Reconcile Account with Zoho Books

Here’s how you can reconcile your bank account in Zoho Books:

- Click on the Banking module in the left sidebar.

- Choose the bank account for which you would like to reconcile transactions.

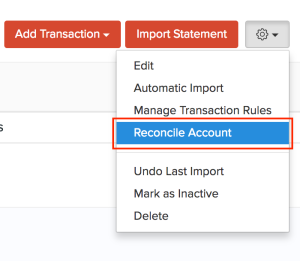

- Head to the Gear icon in the top right corner of the page.

- Select Reconcile Account.

- Tap on the Initiate Reconciliation button in the top right corner of the page.

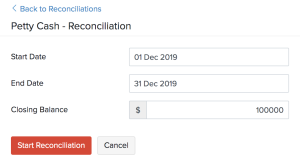

- Add the Start Date and End date of the period you would like to reconcile.

- Enter the Closing Balance of your bank account.

- Tap on the Start Reconciliation.

- Click on the transactions you would like to reconcile.

- Select the +Add Transaction to adjust your clear amount

Note:The reconciliation window will display only transactions that have been matched, categorized, and manually added.

To successfully reconcile your accounts, ensure that the Closing Balance matches the Cleared Amount, resulting in a zero difference. If necessary, you can modify the Closing Balance.

- Tap on the edit icon next to the Closing Balance.

- Enter the amount and click Update.

To reconcile your bank accounts in Zoho Books, you need to ensure that the Closing Balance and Cleared Amount are the same and the difference is zero.

- After you finish reconciling your account, click on Reconcile and finish the process.

- If you want to do the reconciliation later, click Save and Reconcile Later.

After a successful reconciliation, the status of your reconciliation process window will be Reconciled.

Must Read: Advanced data visualization in Zoho Analytics

What Are The Benefits of Reconciling Your Bank and Credit Card Accounts?

Utilizing Zoho Books for bank reconciliation offers numerous benefits, and we – authorized partners of Zoho outline some key reasons why it should be a central component of your company’s accounting approach.

It identifies fraudulent activity

It helps in detecting fraudulent activities. As previously mentioned, by comparing your company’s internal bank records with the transactions recorded by the bank, any discrepancies can be identified.

Sometimes, this process may reveal overlooked transactions, but in other instances, it could uncover unauthorized activities conducted by individuals attempting to misappropriate funds from the company’s account.

It Helps To Prevent Errors

Despite the meticulous nature of your accounting, the possibility of human error always exists. Common mistakes such as double payments, missed payments, lost cheques, and basic arithmetic errors can occur, although adopting digital finance transformation to automate processes throughout your business can help minimize these errors.

Through Zoho Books software for bank and credit card account reconciliation, you can promptly identify and correct any mistakes, regardless of their origin.

Must Read: How Much Can You Save By Migrating To Zoho One?

It Keeps The Account In Good Standings

Maintaining vigilance over your company’s balance with regular bank reconciliation statements reduces the risk of spending beyond your available funds, which could lead to overdrawing or missing payments, negatively affecting your credit score.

Furthermore, it helps in avoiding potential overdraft fees imposed by many banks, resulting in cost savings. Additionally, consistent bank reconciliation statements enable you to promptly identify any new fees charged by the bank, allowing you to investigate the reasons behind them.

It Helps With Receivable Tracking

Facilitating receivables tracking, especially for customers using checks, is simplified through the diligent practice of bank reconciliation. This process ensures a swift identification of any disparities between your accounts, where customer payments are recorded, and your bank account, preventing oversight or misplacement of checks.

What are the Benefits of Using Automated Bank Reconciliation Software?

The above advantages are reasons to invest in bank reconciliation using automated accounting software like Zoho Books. With the best accounting software, you can not only complete the process with fewer errors but also integrate it into the working day much more smoothly.

Choosing the latest automated accounting software – Zoho Books is advantageous for the following reasons:

- Integrated reports enable simultaneous management of multiple bank accounts.

- Simple creation of payments, receipts, and transfers with the flexibility to consolidate multiple times throughout the month.

- Live bank feeds facilitate quicker identification and resolution of discrepancies.

- Automatic matching of transactions is seamlessly integrated into a single process.

- Regular automated uploads of bank transactions expedite period-end closing.

- Enhanced visibility of transactions across your organization for all relevant stakeholders.

How To Leverage Zoho Books for Effortless Reconciliation

Zoho Books not only streamlines the reconciliation process but also enhances it through its user-friendly features and integrated functions.

Auto-Upload Your Bank Statements

Automate the process of uploading your bank statements directly from your email, guaranteeing that no transaction is overlooked during your reconciliation endeavours.

Seamless Transaction Investigation

The capability to hyperlink into individual transactions during reconciliations simplifies the process of investigating discrepancies.

Automated Payments and Transfers via Integrated Payment Methods

Autonomously generating payments and transfers through integration with diverse payment methods significantly simplifies the process of transaction matching.

Effortless Expense Categorization through Zoho Expense Integration

Enable your employees to categorize their corporate card expenses while on the move, ensuring that reconciliation accurately reflects your financial status.

Also Read: Zoho Creator vs Other Low-Code Platforms

Additional Reasons Why Bank Reconciliation Is Valuable with Zoho Books

While maintaining precise records of your financial transactions, the importance of safeguarding against inaccuracies and potential fraudulent activities cannot be emphasized enough.

Zoho Books reconciliation not only optimizes financial management by ensuring data integrity and authenticity but also strengthens defences against inconsistencies and fraudulent activities.

Here, we outline five key aspects that transform reconciliation from a routine check into a fundamental security and accuracy protocol.

- Identifying Fraudulent Activity

- Validating Data Entry

- Authenticating Financial Statements

- Ensuring Accurate Tax Reporting

- Curbing Internal Theft

Need KG CRM SOLUTIONS To Help?

Whether you are just looking for more resources on Zoho Books or need our certified Zoho developers team to help Reconciling Zoho Books, we – authorized partners of Zoho are always here for you! Drop us a line to learn how our zoho expert team can help!